“Revenge Saving : How Americans Are Bouncing Back and Building Wealth”

Revenge Saving Introduction

Many Americans are adopting “revenge saving” as a new financial tactic in 2025. After a time of stress or excessive spending, this powerful trend—driven by economic uncertainty and spending fatigue—means aggressively saving money. Retribution saving reframes saving as taking back control, safeguarding our future, and coordinating spending with our most important objectives rather than eliminating the things we enjoy. Let’s examine this movement’s definition, current significance, and adoption strategies for more financial independence.

1.What is Revenge Saving?

The goal of revenge saving is empowerment, not deprivation. It’s a mental change from routine spending to deliberate saving. Consumers are reportedly emphasizing emergency savings, financial resilience, and purposeful saving more, particularly in the wake of the post-pandemic “revenge spending” spike.

The mental relief that comes from saving and regaining financial stability is acknowledged by this trend.

2.Here’s Why It’s Gaining Momentum

Retaliation saving is fueled by three primary forces:

Economic uncertainty: Americans are compelled to create a safety net due to rising inflation, precarious employment, and price increases brought on by tariffs.

Spending fatigue: Many people now yearn for stability and long-term financial strength after overspending for comfort.

Goal-driven mindset: Saving isn’t just about money for Gen Z and Millennials; it’s also about emotional stability and independence.

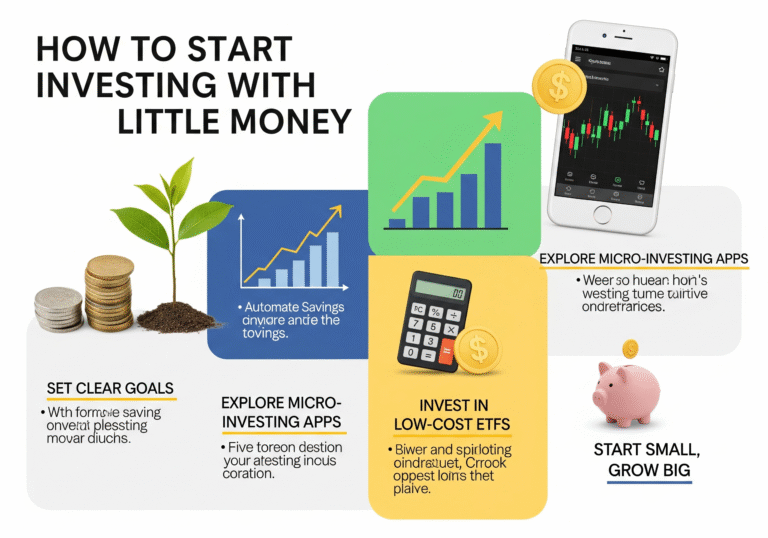

4.Four Simple Steps to Start Revenge Saving

Step 1: Establish Specific, Intentional Goals

To give your savings accounts a deliberate purpose, label them “Emergency Fund” or “House Down Payment.”

Establish both short-term objectives (“$1,000 in three months”) and longer-term benchmarks.

Step 2: Make Everything Automated

Immediately following payday, use automatic transfers from checking to specified savings accounts. You won’t miss it if you don’t see it.

Step 3: Locate and Seal Off Financial Leaks

To identify recurrent leaks, such as unused streaming subscriptions, impulsive purchases, etc., track expenditure for one to two weeks.

Transfer those monies straight to your accounts for retaliation.

Step 4: Accept Short-Term Saving Difficulties

To increase your cash gradually, try weekly or monthly saving sprints. For instance, you may forego one coffee a day for a month.

4.Why Revenge Saving Works

It’s emotionally uplifting: Mental relief is experienced when regretful overspending is transformed into constructive momentum.

It swiftly boosts self-confidence: Little victories add up; seeing your balance improve increases your motivation.

It is adaptable: This approach, in contrast to rigid budgeting, strikes a balance between saving and allowing you to enjoy life (in moderation).

5.Tips to Make It Stick

Visual progress tracking: A physical tracker or apps like Mint might help you stay motivated.

Moderate comfort spending: To prevent burnout, permit thoughtful, modest pleasures.

Engage a buddy or spouse: Accountability is established through goal sharing.

Review every three months: Evaluate results, adjust objectives, and recognize accomplishments.

6.Common Challenges & Solutions

Challenge: Feeling overpowered by ambitious objectives. Solution: Use micro-saving goals to break it down.

Challenge: Unexpected costs are a part of life. Solution: Include little automatic transfers into the recovery fund and keep a modest cushion.

Problem: Losing steam. ← Solution: Honor minor victories—every $100 makes a difference.

7.Long-term Impact of Revenge Saving

creates a sizeable emergency reserve that covers three to six months’ worth of costs.

promotes financial awareness and better spending practices.

serves as a launchpad for long-term stability, debt-free living, and investing.

In conclusion

Saving revenge turns remorse into fortitude. More Americans are taking this route in 2025—consciously spending and saving. Are you prepared to join the movement? It only calls for deliberate actions, automatic routines, and constant action—no drastic sacrifices. Regain your financial confidence by starting today.

10 Best Ways to Save Money Fast in the USA

Best Credit Cards for Beginners in 2025: Top 5 Picks for Building Credit

4 Comments