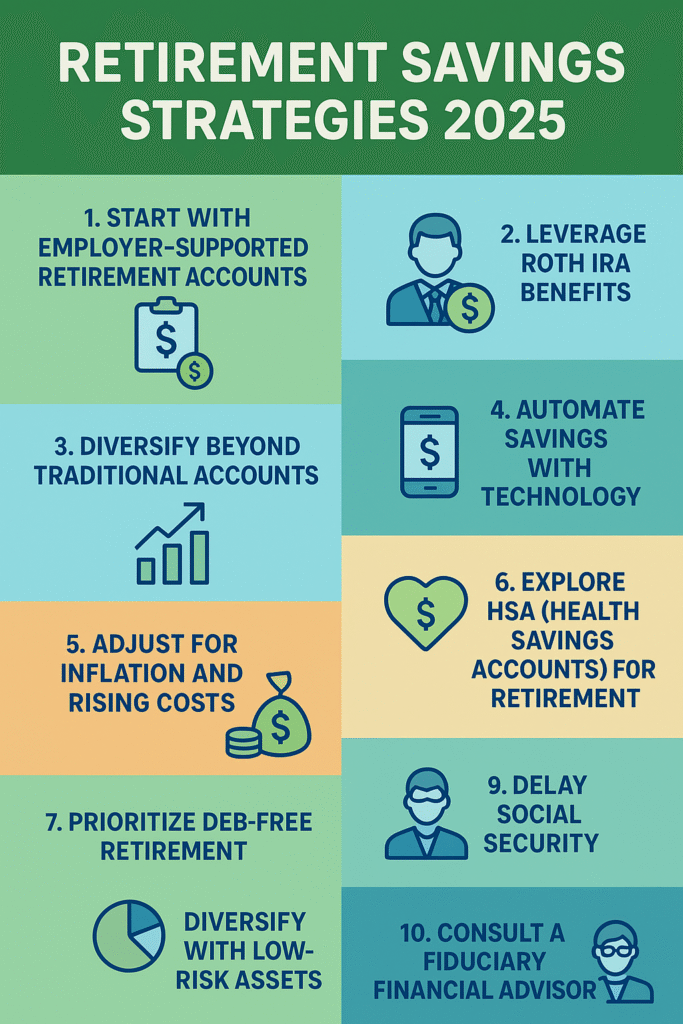

Retirement Savings Strategies 2025 – Secure Your Future Today

Retirement Savings Strategies 2025

Introduction Of Retirement Savings Strategies 2025

In 2025, retirement planning will be more crucial than ever. Americans are looking for more intelligent, secure, and flexible strategies to accumulate wealth during their golden years as a result of inflation, changing market trends, and longer life expectancies. This guide, which is intended for novices, working professionals, and those approaching retirement age, examines realistic retirement savings options for 2025.

Why Retirement Planning in 2025 Is Different

The world of finance is changing. Reliance on Social Security alone is no longer adequate, and traditional pensions are vanishing. People now have to be more accountable for their retirement funds due to rising healthcare costs and lifestyle inflation. The good news? In 2025, there will be new tools and tactics that facilitate preplanning.

1.Start with Employer-Sponsored Retirement Accounts

Contribute as much as you can to any 401(k) or 403(b) plans that your company may offer. Contribution caps are raised in 2025:

- (Under 50) 401(k) / 403(b): $23,000

- Catch-up payments (50+): an extra $7,500

Making the most of these contributions enables you to take advantage of possible employer matches, lower your taxable income, and save pre-tax money.

2.Leverage Roth IRA Benefits

In 2025, one of the most effective retirement strategies will still be a Roth IRA. In retirement, withdrawals are completely tax-free, but contributions are made using after-tax money. The maximum for a 2025 Roth IRA is $6,500, or $7,500 for individuals over 50.

Roth contributions can be a wise choice if you expect to be in a higher tax bracket in the future.

3.Diversify Beyond Traditional Accounts

Don’t depend on retirement accounts alone. In 2025, investors are accumulating retirement funds and taxable brokerage portfolios. Why?

- Greater adaptability

- Access to stocks that pay dividends

- Emergency liquidity

You have more power when you create both taxable and tax-advantaged assets.

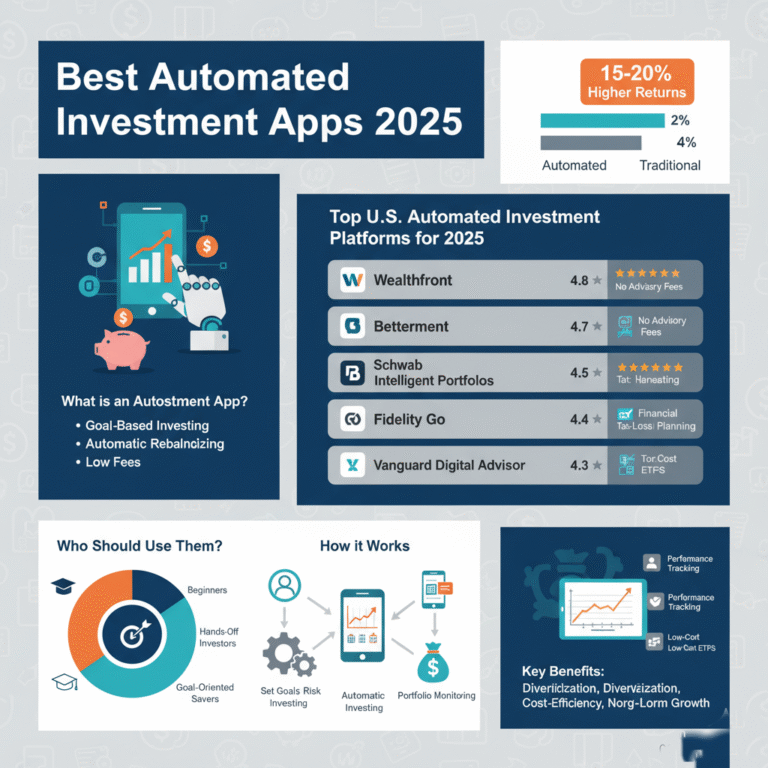

4.Automate Savings with Technology

In 2025, robo-advisors and fintech apps will make saving money simpler. Retirement forecasts, portfolio balancing, and automated contributions are made possible by platforms such as Betterment, Wealthfront, and Fidelity’s robo-advisor. Procrastination and human error are lessened by automation.

5.Adjust for Inflation and Rising Costs

Underestimating inflation is one of the most common errors made by investors. The average rate of inflation is expected to be around 3% in 2025. Even though it might not seem concerning, it drastically lowers purchasing power over decades.

To counteract this:

- Invest in assets that are safeguarded against inflation, such as Treasury Inflation-safeguarded Securities, or TIPS.

- Invest in commodities, REITs, and real estate to diversify.

- Make regular adjustments to retirement contributions.

6.Explore HSA (Health Savings Accounts) for Retirement

One of the biggest costs in retirement is still healthcare. The HSA contribution caps went up in 2025:

- $4,300 per person

- Family: $8,550

HSAs have three tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical costs. HSAs are become a common “secret retirement weapon” used by retirees.

7.Prioritize Debt-Free Retirement

Savings can be destroyed if high-interest debt is carried into retirement. Financial gurus advise rapidly paying off personal loans, credit cards, and even mortgages (if possible) before to retirement in 2025. Your retirement income will give you greater freedom the less debt you have.

8.Diversify with Low-Risk Assets

Stocks should not be the exclusive component of retirement investments. Annuities, dividend stocks, and bond exchange-traded funds (ETFs) are becoming more and more popular in 2025 among retirees looking for stability. Many people find success with a balanced portfolio that consists of 60% stocks, 30% bonds, and 10% alternative investments.

9.Delay Social Security (If Possible)

Compared to filing at age 62, waiting until age 70 can result in a 32% increase in monthly income from Social Security. Delaying Social Security is a tried-and-true long-term strategy for people who have other sources of income in early retirement.

10.Consult a Fiduciary Financial Advisor AND Retirement Savings Strategies 2025

In 2025, scams and misleading financial advice remain a concern. Always work with a fiduciary advisor, legally bound to act in your best interest. Look for fee-only financial planners with transparent pricing.

Final Thoughts Of Retirement Savings Strategies 2025

In 2025, retirement planning should focus on foresight, diversification, and balance. You may ensure future financial independence by integrating technology, healthcare planning, inflation-proof measures, and traditional retirement plans.

Now is the perfect time to take action, regardless of when you’re starting or when you’re about to retire. Compounding has a greater ability to create a solid retirement portfolio the earlier you start preparing.

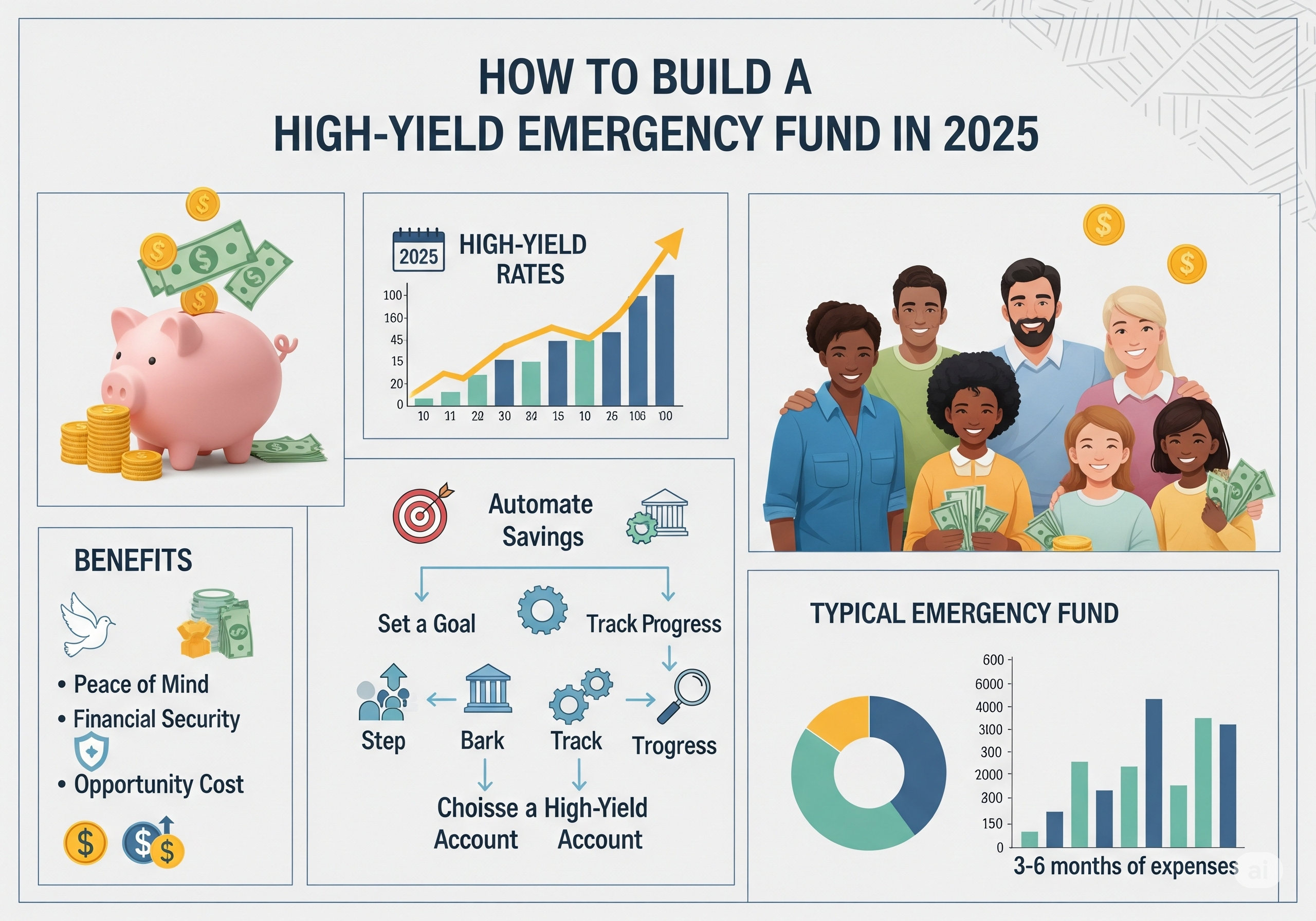

how-to-build-a-6-month-emergency-fund