Online Investing for Beginners in the U.S.—Start Smart in 2025

Online investing for beginners USA

Introduction Of online investing for beginners USA

“It can be intimidating to begin investing in the United States, but with the correct advice, you can start making wise financial decisions right away. Everything you need to know to begin investing online in 2025 with clarity and confidence will be covered in this approachable handbook for beginners.

- Are you prepared for financial growth in 2025? This is where to begin.

- “Your step-by-step path to smart investing in the U.S. begins here.”

- “No prior experience? No issue. Discover the proper methods for making internet investments.

- “Turn your savings into growth — start investing smart in 2025.”

- “Begin your wealth-building journey today with simple, proven steps.”

1.Why Start Investing Now? AND online investing for beginners USA

While investing allows your money to increase, saving is safe. Investing is the answer when inflation continuously reduces the purchasing power of your money. Time and compound interest are strong partners; even modest, regular contributions can add up to a significant future. First-time investors can now invest online thanks to automated tools, cheap minimums, and user-friendly platforms. Even if you start with just $5 per week, you’re still taking advantage of the market’s growth potential by starting today.

2.Choosing a Beginner-Friendly Platform

Here’s how to choose an investment instrument that suits your comfort level and skill set:

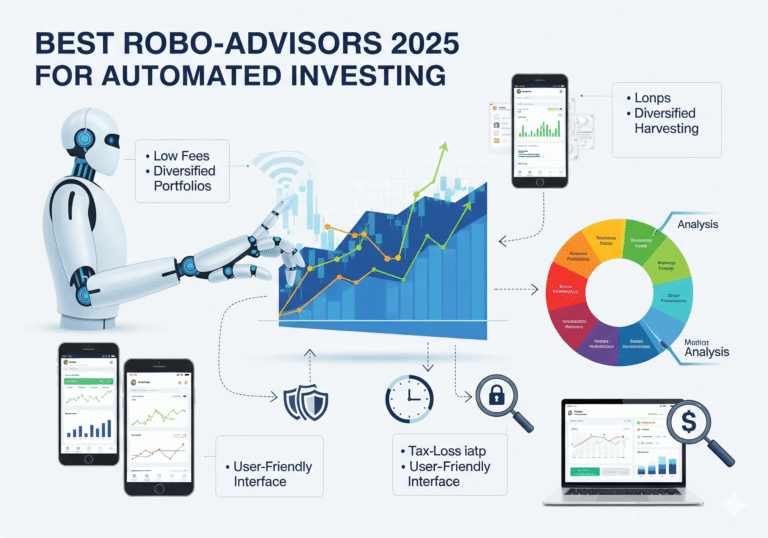

Robo-advisors, such as Wealthfront and Betterment:

- Automated portfolios based on your objectives and risk tolerance

- For novices, low costs and hands-off investment are perfect.

Apps for brokers (Robinhood, Schwab, and Fidelity):

- Availability of mutual funds, equities, and ETFs

- Low-cost choices, user-friendly interfaces, and educational materials

Apps for microinvesting (Acorns, Stash):

- Put spare change from everyday purchases into a diverse portfolio by rounding it up.

- Begin investing with a small sum of money; this is ideal for trial and error.

Investing confidence and dedication are increased when you have a platform that works for you.

3.Core Investment Strategies

The following are essential tactics for long-term success:

Invest in a variety of industries to diversify your portfolio and maintain a balanced level of risk.

Dollar-Cost Averaging: The danger of market timing is decreased by regular investing. Allow consistent modest investments to support long-term expansion.

Reinvest Dividends: Configure automatic dividend compounding. In the long run, this greatly increases returns.

Create an Emergency Fund First, fund a savings account with three to six months’ worth of spending. An established financial safety net should be followed when investing.

Establish Long-Term Objectives: Steer clear of emotional trading. Prioritize long-term goals like independence, homeownership, or retirement over short-term market fluctuations.

4.Mistakes to Avoid

Be mindful of typical beginner pitfalls:

Following trendy Stocks: Stocks that are trendy or viral might cause rapid losses. Long-term success comes from steady tactics.

Ignoring Fees: Returns are weakened by high expense ratios. Choose no-fee platforms and inexpensive ETFs.

Emotional Responses: The market is subject to change. Refrain from panic selling; patience is a virtue in long-term investing.

5.Bonus Expert Tips

Begin Small, Grow Slowly:

Over time, even $50 per month adds up. Little donations are preferable to waiting for “big money.”

Automate Your Investments: Planned transfers help investors become more consistent and disciplined.

Track Progress: To stay motivated, keep an eye on growth using portfolio applications or platform dashboards.

Keep Up to Date: To deepen your understanding of investing, use reliable sites such as Investopedia, NerdWallet, or this blog.

6.Final Thoughts

It’s easier and more convenient than ever to begin investing in 2025. You can make money with the correct platform, astute tactics, and perseverance. For financial success, start investing early, stick with it, and take advantage of compound growth and time.

10-best-ways-to-save-money-fast-in-the-usa

best-credit-cards-for-beginners-in-2025

4 Comments