How to Start an Emergency Fund in 2025: A Step-by-Step Guide

How to Start an Emergency Fund in 2025

Introduction OF How to Start an Emergency Fund in 2025

Unpredictability is a part of life. Your financial stability may be disrupted by unexpected auto repairs, medical expenses, or job loss. An emergency fund can help with that. You can avoid debt and feel more at ease knowing that you have money set aside for unforeseen circumstances.

We’ll explain how to establish an emergency fund in 2025 in this blog, even if you have a limited budget. This book will walk you through every stage of creating financial security, from determining how much to save to selecting the best account.

Why You Need an Emergency Fund

Let’s examine the “why” before moving on to the “how.” An emergency fund serves as a safety net for finances.

- Avoids Debt: Prevents dependence on loans or credit cards.

- Peace of Mind: Lessens anxiety when things are unclear.

- Despite failures, financial stability helps you stay on course for your long-term objectives.

- Flexibility: Enables you to deal with crises without affecting your retirement funds or investments.

Step 1: Decide How Much to Save

Three to six months’ worth of living expenditures should be saved, according to experts. Start small, though, if it seems daunting.

- $500 to $1,000 is the starting goal for urgent necessities.

- Long-Term Objective: Sufficient to pay for groceries, rent, bills, and other necessities for a few months.

Tip: Figure out how much you need each month for things like rent, food, utilities, and transportation. To determine your goal, multiply by three to six.

Step 2: Open a Separate Account

It is not advisable to combine your emergency fund with your ordinary checking account.

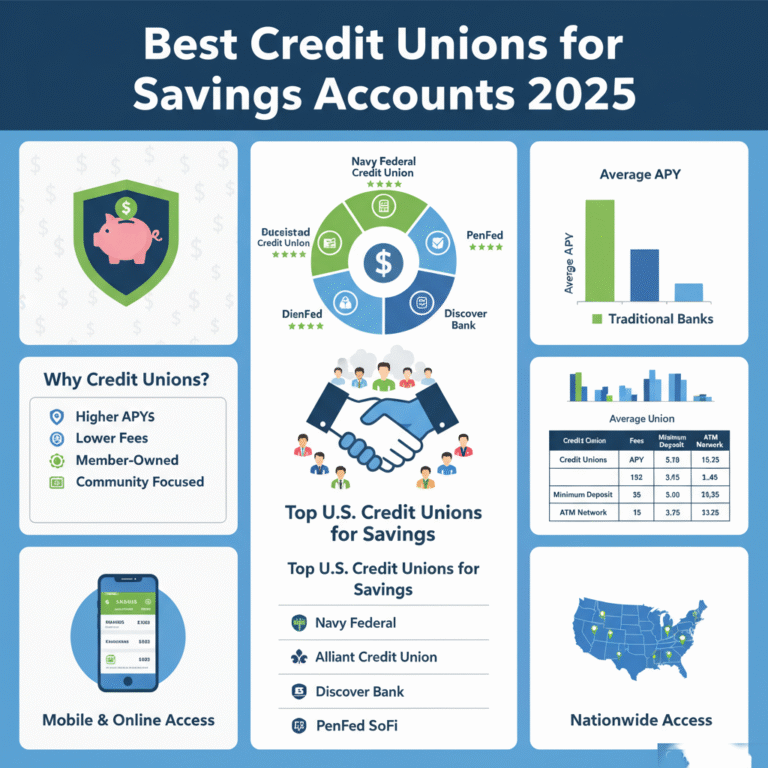

Top choices for 2025:

- Interest-bearing and safe is the High-Yield Savings Account (HYSA).

- Money Market Account: Limited transactions but higher interest rates.

- Online banks frequently provide higher interest rates than conventional banks.

Step 3: Automate Your Savings

Consistency is key. Set up automatic transfers from your paycheck or checking account into your emergency fund.

- Even $20–$50 per week adds up over time.

- Treat your emergency savings like a bill you must pay every month.

Step 4: Cut Unnecessary Expenses

If saving money seems unachievable, try these methods:

- Unused subscriptions can be canceled.

- Make meals at home rather than going out to dine.

- Restrict impulsive purchases.

- Use cashback apps when you shop regularly.

Put the money you save in your emergency fund.

Step 5: Use Windfalls Wisely

Tax refunds, bonuses, or side hustle income can give your fund a quick boost. Instead of spending it all, deposit at least 50% into your emergency account.

Step 6: Keep It for Real Emergencies

You should not use your emergency fund for non-urgent needs, shopping, or vacations. Use it exclusively for:

- Emergencies related to health

- Loss of employment

- Major home or auto repairs

- Unexpected family issues that require travel

Step 7: Replenish After Use

If you dip into your emergency fund, make it a priority to rebuild it. Go back to automatic transfers until you reach your target again.

Common Mistakes to Avoid AND How to Start an Emergency Fund in 2025

- Keeping cash on hand at home increases the chance of theft or temptation to spend.

- Combining it with regular accounts makes it simple to go over budget.

- Not even getting started: Security is delayed if you wait till you “have extra money.”

FAQs on Emergency Funds

- In 2025, how much should a novice save?

ANS:Build up to three to six months’ worth of costs from a starting point of $500 to $1,000. - Should my emergency fund be invested?

ANS:No, emergency funds shouldn’t be placed in stocks or other erratic assets; instead, they should be safe and liquid. - Where should my emergency savings be kept?

ANS:The greatest choice for safety and interest in 2025 is a high-yield savings account. - Are couples allowed to have a single emergency fund?

ANS:Yes, a shared emergency fund that covers both income and expenses should be established by couples.

Conclusion OF How to Start an Emergency Fund in 2025

It is not necessary to start an emergency fund in 2025. Be disciplined, start small, and automate your savings. You’ll gradually create a financial safety net that provides you with peace of mind and shields you from life’s unforeseen events.

Keep in mind that developing the habit and maintaining consistency are more important than how much you save today.

how-to-build-a-6-month-emergency-fund