How to Save Money on a Low Income in 2025: Practical Tips That WorkIntroduction

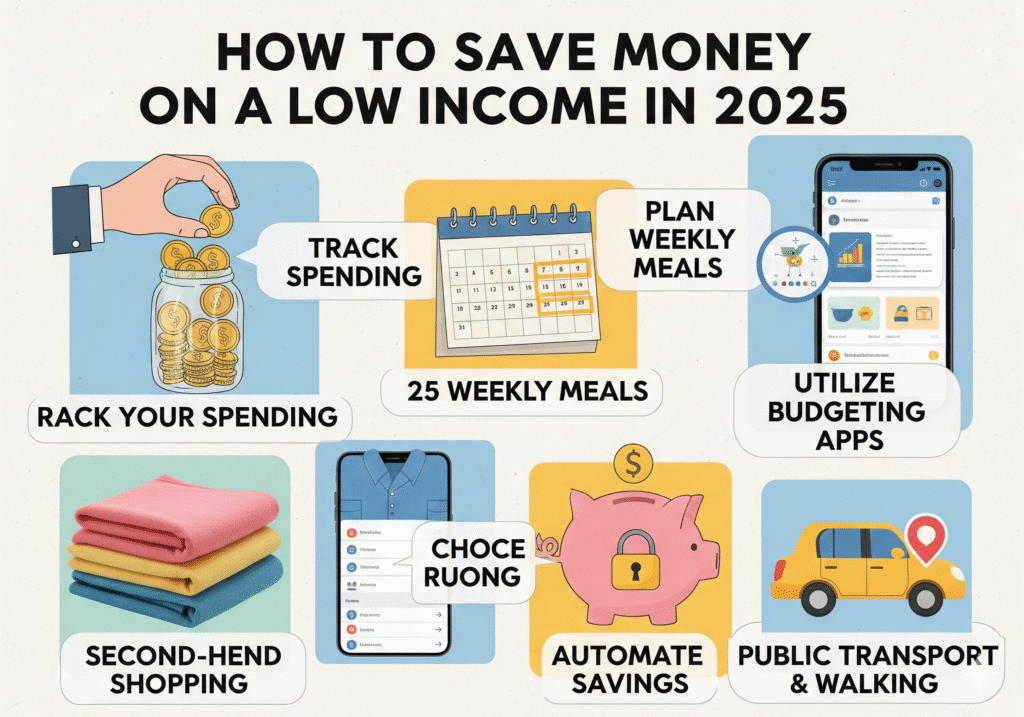

“How to Save Money on a Low Income in 2025”

Introduction OF How to Save Money on a Low Income in 2025

It’s not simple to live on a modest wage in 2025. Saving money can seem unachievable due to rising rent, increased grocery costs, and unforeseen expenses. However, even with a restricted salary, you can still save money. The secret is to employ tactics that work in real life and to be deliberate with every dollar. You can achieve financial stability without making six figures. You can stretch your income further, lessen stress, and begin building a safety net for the future by making tiny, regular adjustments.

This guide outlines doable, realistic strategies for 2025 low-income savings. Complex systems or in-depth financial understanding are not necessary to follow these ideas. Rather, they emphasize concrete actions that everybody may take right now.

1.Understand Your Income and Expenses

Knowing exactly where your money is going is the first step to saving on a limited salary. The majority of people underestimate their spending, which makes budgeting more difficult. Begin by keeping a month-long record of your earnings and outlays.

Free programs like Mint, YNAB (You Need a Budget), or even a basic spreadsheet can be used. List your variable expenses, such as groceries, dining out, and entertainment, as well as your set expenses, such as rent, utilities, and transportation.

For instance, you are aware that about half of your salary is already committed if your monthly income is $2,500 and your rent is $1,200. You can identify spots to chop without speculating when you see these statistics plainly. Knowing your financial situation allows you to take charge rather than responding to financial hardship.

2.Create a Bare-Bones Budget

Only necessities are the emphasis of a bare-bones budget. Although it’s not intended to last forever, it’s a useful tool in times of financial hardship. Make a list of your top priorities, including housing, food, utilities, healthcare, and transportation. Anything that doesn’t fit under necessities should be cut or put on hold.

For a few months, for instance, terminate any unused Netflix or Spotify memberships. Making coffee at home rather than at Starbucks can result in monthly savings of at least $80. You can save hundreds of dollars by cooking basic meals rather than eating out.

This kind of budget is about surviving and allowing yourself some breathing room, not about deprivation. Small indulgences can be restored whenever your circumstances improve.

3.Smart Ways to Cut Daily Expenses

Little adjustments to regular routines can result in significant cost savings:

- Preparing meals at home helps you avoid last-minute takeout by planning your meals for the week. Cooking at home might save a family between $150 and $200 a month.

- Purchase generic brands: Store-brand products are often less expensive yet have a similar flavor.

- Use discount and cashback apps: Rakuten, Honey, and Ibotta are just a few of the tools that can help you save money automatically.

- Reduce transportation expenses by riding your bike, carpooling, or using public transportation wherever you can. This can save hundreds of dollars a year, especially as gas costs rise.

- Energy efficiency: To save utility costs, unplug electronics, turn off unnecessary lights, and modify thermostat settings.

These actions only stretch your current revenue; they don’t require you to create extra money.

4.Increase Savings Automatically

Waiting until the end of the month can make saving money seem unattainable. Pay yourself first instead. Every payday, set up a $25 automatic transfer from your checking account to a savings account. That’s $600 saved without effort over a year.

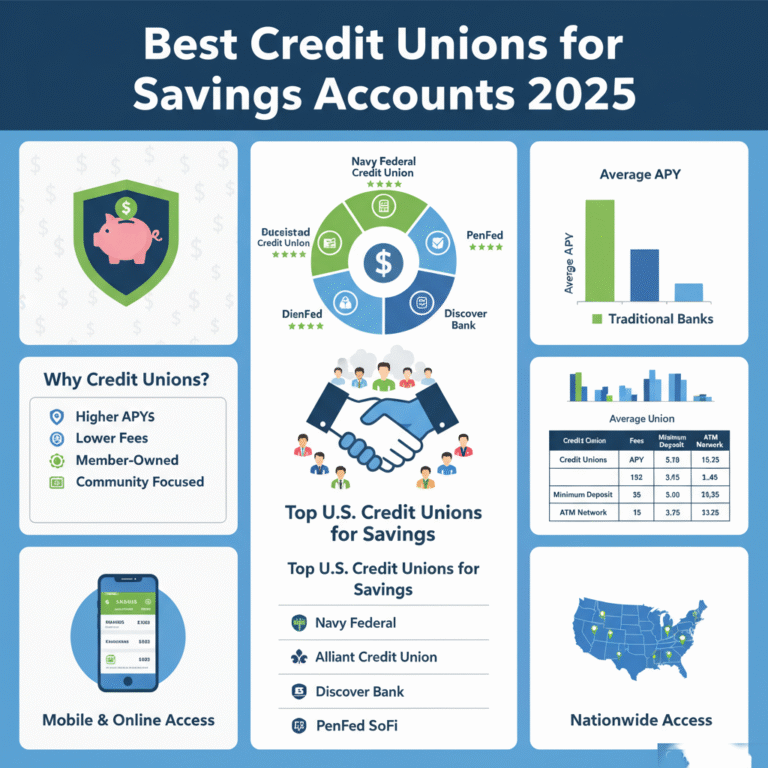

Use a high-yield savings account (HYSA) if at all possible. Interest rates offered by online banks such as Ally, Marcus, and Discover are significantly greater than those of conventional banks. This implies that while your money is in savings, it increases more quickly.

Momentum is created by even tiny amounts. Even a small rise in your account balance can inspire you to keep saving.

5. Side Hustle Opportunities in 2025 AND How to Save Money on a Low Income in 2025

The next phase is to generate more revenue if your expenses are presently as low as possible. Finding flexible work is made easier by the gig economy’s continued growth in 2025.

Among the concepts are:

- Online freelancing: You can make money using abilities like writing, graphic design, or virtual help on platforms like Upwork and Fiverr.

- You can make money on your own time with delivery or ride-sharing applications like DoorDash, UberEats, or Instacart.

- Selling unwanted goods: To get rid of clutter and earn money, utilize Facebook Marketplace, Poshmark, or eBay.

- Online tutoring and coaching: If you possess specific knowledge, you can interact with students through platforms such as Wyzant or Preply.

When living on a limited budget, even an additional $200 to $300 a month from a side business can make a huge difference.

6.Debt Management for Low Income AND How to Save Money on a Low Income in 2025

Because high-interest payments reduce your income, debt makes saving considerably more difficult. If you have debt, concentrate on making strategic payments on it. Two widely used techniques are:

Debt snowball: Make minimal payments on the remaining amounts while paying off the smallest balance first. Momentum is increased by this.

Debt avalanche: To save the most money over time, pay off the debt with the highest interest rate first.

If debt seems too much to handle, think about using the National Foundation for financial Counseling (NFCC), which offers free or inexpensive financial counseling services in the US. Receiving expert assistance can help reduce the stress associated with repayment.

7.Build an Emergency Fund Slowly AND How to Save Money on a Low Income in 2025

Having an emergency fund shields you against monetary catastrophes. Your objective doesn’t have to be $10,000 at first; start small. When unforeseen needs arise, even $500 can keep you from getting into further debt.

You may automatically save extra change from purchases by rounding it up with apps like Acorns or Chime. Those small sums add up to a significant emergency fund over time.

8.Mindset Shift: From Survival to Growth AND How to Save Money on a Low Income in 2025

Living with a low income can be discouraging, but keep in mind that even a small amount of saving puts you ahead. You might not save thousands of dollars right away, but consistency is more important than size. Consider saving as a habit rather than a destination. Saving small amounts of money improves financial strength over time, much like regular exercise improves health.

Conclusion OF How to Save Money on a Low Income in 2025

It’s difficult, but not impossible, to save money in 2025 on a modest wage. The secret is to combine simple, doable steps: keep track of spending, make a basic budget, reduce daily expenses, automate saves, look into side projects, and carefully handle debt. Take the first move that feels the simplest right now.

Even if your initial savings are merely $5 or $10, that’s progress. Over time, small sums increase, particularly when combined with patience and discipline. Recall that consistency and wise financial decisions are more important for financial security than income level. You may stretch your income, lower your stress level, and gradually create a better financial future by putting these techniques into practice.

best-credit-cards-for-beginners-in-2025