How to Save for a Down Payment in 2025

How to Save for a Down Payment in 2025

Introduction OF How to Save for a Down Payment in 2025

Purchasing a home is one of the most significant financial turning points in the lives of many Americans. However, saving for a down payment feels overwhelming due to the escalating cost of housing in the United States. If you intend to upgrade in 2025 or are a first-time purchaser, a solid savings plan can help you reach your objective.

The best ways to save for a down payment in 2025 are covered in this book, along with advice on budgeting, investing, and avoiding common pitfalls. By the conclusion, you’ll have a detailed plan of action to realize your ambition of becoming a homeowner.

Why a Down Payment Matters

The money you put down up front when buying a house is known as a down payment. You will need to borrow less money if you have a greater down payment. This has a number of benefits:

- Reduced Monthly Payments: Mortgage payments are reduced when more money is paid up front.

- Improved Loan Terms: In exchange for larger down payments, lenders provide better interest rates.

- Avoiding PMI: You can avoid private mortgage insurance if you put down at least 20%.

- Instant Equity: You will immediately own a larger portion of your home if you make a larger down payment.

The average price of a home in the United States is still high in 2025, but you can reach your goal more quickly with careful financial preparation.

Step 1: Set a Realistic Down Payment Goal

Decide how much you’ll need before you start saving.

- A conventional loan typically demands a down payment of 5% to 20%.

- FHA Loan: For first-time buyers, the down payment is as low as 3.5%.

- For qualifying purchasers, VA and USDA loans occasionally don’t demand a down payment.

For instance, a 10% down payment on a $300,000 house would be $30,000. Understanding your goal helps you stay motivated and provides clarity.

Step 2: Create a Dedicated Savings Plan

Start a targeted savings plan as soon as you know the amount.

- Create a Different Account: To prevent spending, keep your down payment money apart.

- Automate Transfers: Configure recurring deposits for every paycheck.

- Establish a Timeline: Choose if you wish to purchase in one, three, or five years.

Advice: You can’t avoid saving for your down payment; treat it like a monthly bill.

Step 3: Cut Unnecessary Expenses

You get closer to your home with each dollar you save. In 2025, American households will spend a lot of money on impulsive purchases, eating out, and subscriptions.

Methods for cutting expenses:

- Terminate any unused gym or streaming subscriptions.

- Cook more often at home.

- Look for used furniture or clothing.

- Make use of coupons and cashback apps.

Your savings can grow by $2,400 annually with just an additional $200 saved each month.

Step 4: Increase Your Income

Spending less on its own might not be sufficient. Think about using side gigs to increase your income.

- Platforms such as Fiverr and Upwork are used for freelancing.

- Gig Economy: delivering with DoorDash, driving for Uber, or renting out a spare room.

- Use Facebook Marketplace, Etsy, or eBay when selling online.

There are plenty of flexible and remote side jobs available in 2025, and even a few hours per week can help you save more money.

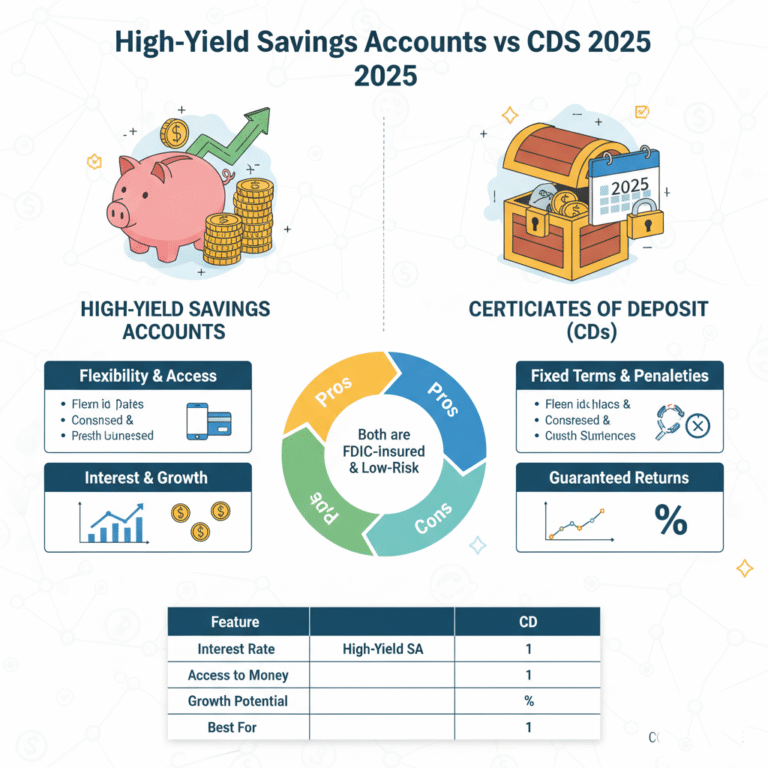

Step 5: Use High-Yield Savings Accounts

Don’t let your funds go unused. In 2025, interest rates on high-yield savings accounts (HYSAs) will be between 4% and 5%, which is significantly higher than those of ordinary accounts.

Benefits :

- protected against bank failures by FDIC insurance.

- When ready to purchase, it is simple to obtain.

- Every month, interest compounds to help your money grow more quickly.

Bonuses—free money toward your goal—are even offered by certain banks when you start a new account.

Step 6: Consider Short-Term Investments

If your home purchase is 3+ years away, you can invest part of your savings.

Options include:

- Certificates of Deposit (CDs): Fixed returns, safe option.

- Treasury Bonds: Low-risk government-backed securities.

- Index Funds or ETFs: Higher growth potential, but best for longer timelines.

Caution: Don’t put all your money in volatile investments. You don’t want your down payment fund at risk if the market dips.

Step 7: Take Advantage of Assistance Programs

As of 2025, a large number of U.S. states and towns continue to provide first-time homebuyers with down payment help.

Among the examples are:

- Housing Finance Agencies (HFAs) at the state level.

- programs for homebuying supported by employers.

- grants for public servants, teachers, and veterans.

Find out the programs you are eligible for by researching the housing authority in your state.

Step 8: Avoid Common Mistakes

- Using Credit Alone: Avoid using your credit cards to their limit when attempting to save money.

- Raiding Retirement Funds: Unless it’s absolutely required, don’t take money out of your 401(k) or IRA.

- Ignoring Credit Score: Lower mortgage rates are associated with higher credit scores.

- Waiting Too Long: Keep in mind that home values can increase, so strike a balance between saving and taking appropriate action.

Step 9: Stay Motivated AND How to Save for a Down Payment in 2025

At first, saving tens of thousands may seem unattainable. Stay inspired by:

- monitoring development every month.

- commemorating accomplishments (such as reaching 25%, 50%, or 75% of your target).

- imagining the house of your dreams.

Since saving is a marathon rather than a sprint, motivation is essential.

Conclusion OF How to Save for a Down Payment in 2025

It may seem difficult to save for a down payment in 2025, but it is possible with the correct approach. Begin by establishing a reasonable objective, reducing spending, raising revenue, and allocating funds to the appropriate accounts. You’ll have the keys to your new house sooner than you might have imagined if you combine available aid programs with diligent saving.

Keep in mind that it becomes easier the earlier you begin. You may get closer to becoming a homeowner tomorrow by taking even tiny efforts today.

online-investing-for-beginners-usa