How to Build a High-Yield Emergency Fund in 2025

1.High-Yield Emergency Fund Introduction

Many Americans view their checking account as a savings account, but in the current inflationary environment, that passive income is gradually depreciating. According to NerdWallet US News, high-yield savings accounts (HYSAs) currently offer an annual percentage yield (APY) of 4–4.5%, which is far higher than the 0.38% national average.

Building an emergency fund in a high-yield account is not only wise, but essential in 2025. This tutorial shows you how to set one up properly so that your safety net is not only secure but also profitable.

2.Why a High-Yield Emergency Fund Makes Sense

Beat inflation: Keeping money in low-earning accounts results in long-term loss because inflation is still above 3%. At 4.35%, a HYSA generates $435 on $10,000, but a checking account only generates $4.60

Improved accessibility: In contrast to CDs, HYSAs offer competitive returns and are liquid, making them ready for emergencies.

Growing need: According to Bankrate Empower, 37% of Americans used their savings in the previous year, and nearly 25% of Americans had no emergency savings at all.

3.How Top HYSA Rates Compare in 2025

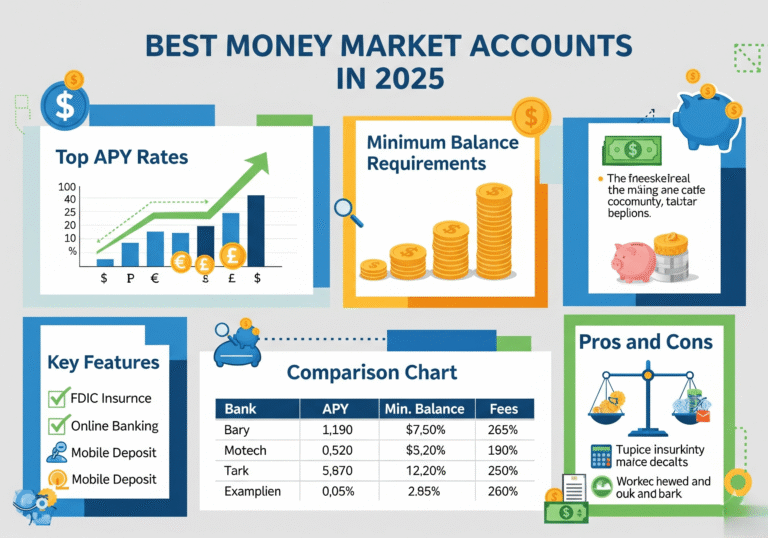

Here is a sample of the most competitive prices:

4.46% Axos Bank APY

Zynlo Bank/Newtek Bank: 4.35% APY

Peak Bank: APY of 4.35%

Bask Bank, EverBank, Rising Bank, and TAB Bank provide 4.25–4.30% APY according to NerdWallet’s Kiplinger Bankrate +1.

These options are fee-friendly and FDIC-insured, making them perfect for emergency savings, even though rates differ depending on the institution and deposit quantity.

4.Step-by-Step Guide

Step 1: Calculate Your Target Fund

Make a list of your monthly essentials, including rent, utilities, food, insurance, and transportation.

Multiply by three to six months, or more if your sector is erratic. Many advise saving up to nine to twelve months in 2025 if there is a substantial possibility of unemployment.

Step 2: Choose the Right HYSA

- Selection criteria for the top HYSA:

- The highest APY that is accessible

- Low or no monthly fees

- Minimal or no initial payment

- Simple internet access and FDIC insurance

If you require the ability to write checks, money markets are an additional choice.

Step 3: Automate Your Savings

Establishing automated transfers from checking to your HYSA on payday will make saving simple. Even little sums pile up; $200 each week turns into more than $10,000 annually.

Step 4: Boost Savings

Put bonuses, tax returns, or earnings from a side business into your HYSA.

To free up more money for savings, reduce ongoing costs like unused subscriptions or accelerate the payoff of high-interest debt.

5.Overcoming Common Concerns

- What happens if rates decline? Your money continues to grow better than it would in a default bank, even if APYs decline. If necessary, switch providers.

- Do you require access in an emergency? Usually, HYSAs permit six free withdrawals each month, or they maintain a small checking buffer for contingencies.

- Are you tempted to spend money? To limit simple access, keep your HYSA at a different bank from your primary checking account.

6.Long-Term Payoff

If you save $10,000 at 4.3% annual percentage yield (APY), you will eventually make $430. When compared to accounts with very no interest, that additional boost becomes substantial. Additionally, a well-funded safety net fosters concentration on more important objectives, such as investment, debt repayment, or mental clarity.

7.High-Yield Emergency Fund Final Thoughts

By 2025, your emergency fund will be able to generate income in addition to protecting it. Every dollar should generate income at readily available rates that are more than double digits higher than the national average. Let your HYSA do the heavy lifting for you by starting small and remaining consistent.

Summary Table

| Step | Focus |

|---|---|

| 1 | Calculate 3–12 months needed |

| 2 | Choose top HYSA (4+% APY, no fees) |

| 3 | Automate deposits |

| 4 | Boost with windfalls & cutbacks |

| 5 | Let interest compound & review annually |

4 Comments