How to Build a 6-Month Emergency Fund: A Step-by-Step Guide for 2025

Introduction Emergency Fund

Having a financial safety net is now necessary in the unstable economy of today. An emergency fund serves as a safety net against unforeseen costs like auto repairs, medical expenditures, or job loss.

Even if you’re starting from scratch, we’ll walk you through the process of creating a 6-month emergency fund in 2025 in this tutorial.

What is an Emergency Fund?

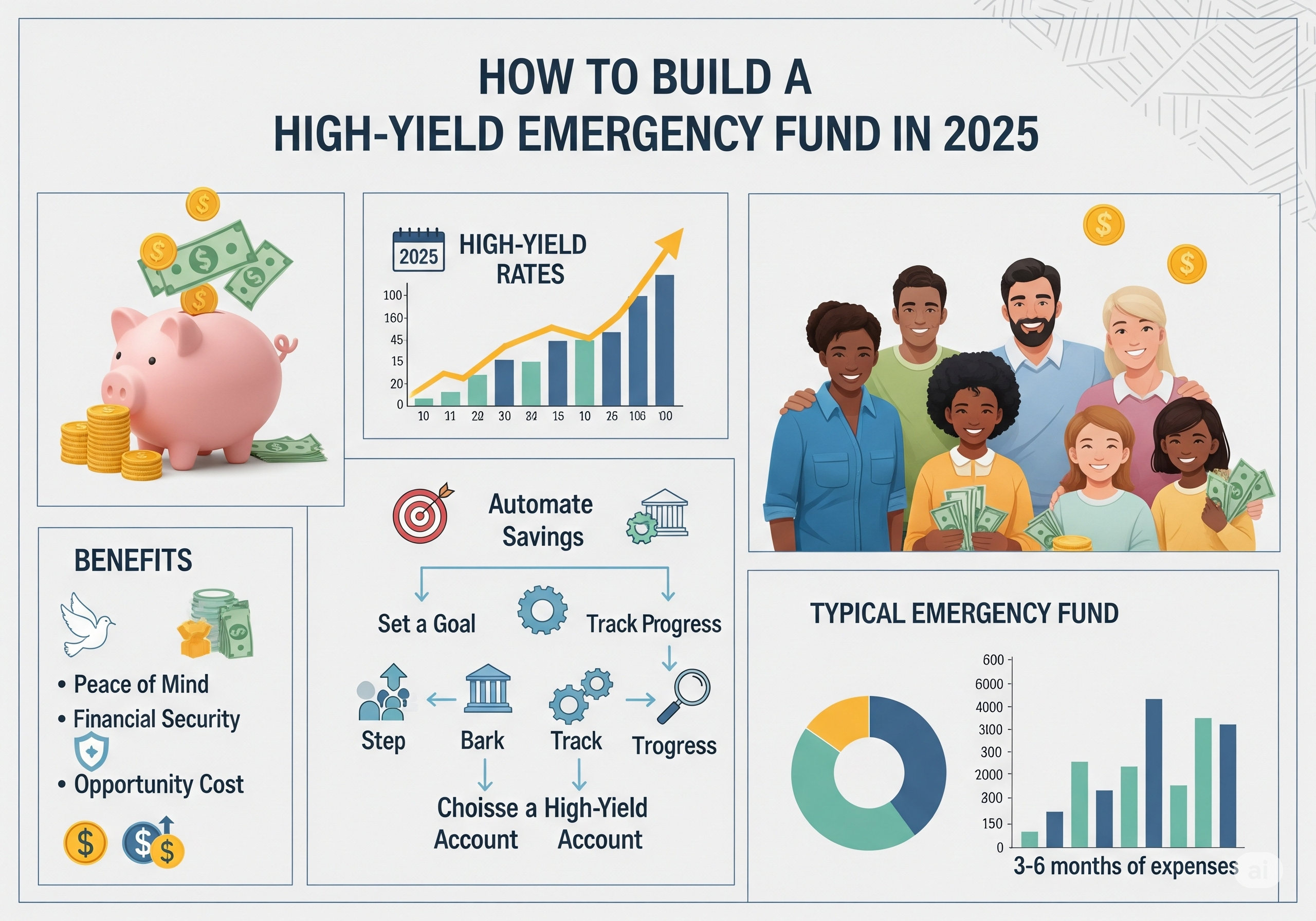

A specific sum of money set aside to cover unforeseen costs is known as an emergency fund. At least three to six months’ worth of living expenses should be saved, according to financial experts.

For instance:

Costs per month: $2,500

Goal for the 6-month emergency fund: $15,000.

Why 6 Months is the Sweet Spot in 2025

In 2025, a three-month reserve could not be sufficient due to inflation, layoffs, and growing living expenses. After six months, you get:

✅ It’s time to look for a new career without fear

✅ Comfort throughout recessions

✅ Safety from health crises

Step 1: Calculate Your Target Amount

Begin by totaling your monthly basic expenses, including:

- Mortgage or rent

- utilities (internet, water, and power)

- Food and Supplies

- Premiums for insurance

- Costs of transportation

- Minimum payments on debt

- For instance, your 6-month target is $12,000 if your monthly basic expenses are $2,000.

Step 2: Choose the Right Savings Account

Your emergency fund ought to be:

- Safe (no investments that carry risk)

- Accessible

- Getting interest

Top choices for 2025:

- Account for High-Yield Savings (HYSA) (APY ~4–5%)

- Account for Money Markets

- Bank Savings Account Online

💡 Advice: Don’t store it in your checking account because it will be too easy to spend.

Step 3: Set a Realistic Timeline

You don’t have to save the whole sum at once. Divide it into more manageable objectives.

An example timeline

Objective: $12,000 within 18 months

Savings required per month: $667

Step 4: Automate Your Savings

Saving is effortless with automation. Every paycheck, set up an automated transfer from your checking to your savings.

For instance:

Paycheck is delivered on Friday.

On Monday, $300 was automatically sent to the emergency fund account.

Step 5: Cut Costs & Boost Income

Methods for making extra cash:

- Terminate any subscriptions that aren’t being used.

- Instead of eating out, prepare meals at home.

- When you shop, use cashback applications.

- Online sales of unused goods

Methods for raising income:

- Start a side business as a freelancer.

- Provide your services on Upwork or Fiverr.

- Use Airbnb to rent out extra room.

Step 6: Keep It Untouched

You should only use your emergency fund for actual emergencies.

✔ Loss of employment

✔ Health care expenses

✔ Immediate auto or home repairs

Not for:

❌ Holidays

❌ New technology

❌ Shopping for non-essential items

Step 7: Refill If Used

Rebuilding your fund should be your first concern if you take money out of it. Make a plan to replace it in three to six months, for instance, if you spent $1,000.

Extra Tips for 2025

- To account for inflation, review your budget every three months.

- To lessen temptation, open an account with a different bank.

- Make good use of windfalls—bonuses, tax returns, or side income can help you reach your savings target more quickly.

Conclusion

In 2025, having a 6-month emergency fund is not just wise, but also essential. Automate your saves, start small, and be consistent. Every dollar you save will be worth the financial stability and peace of mind you’ll have.

10 Best Ways to Save Money Fast in the USA

“Revenge Saving: How Americans Are Bouncing Back and Building Wealth”

3 Comments