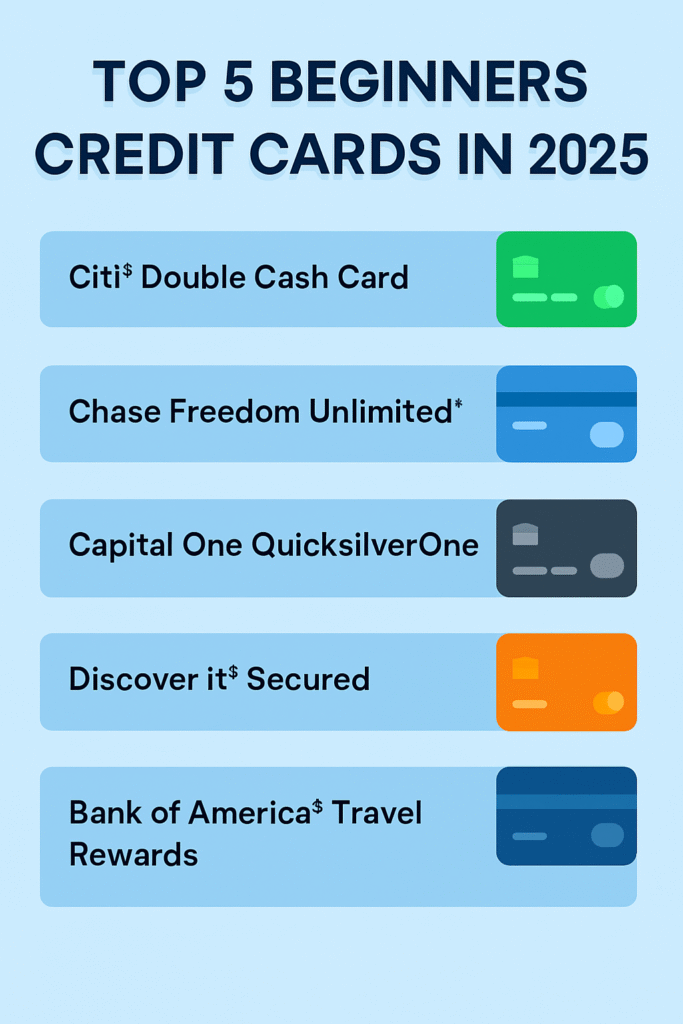

Best Credit Cards for Beginners in 2025: Top 5 Picks for Building Credit

Best Credit Cards for Beginners in 2025

Introduction

It can be difficult to choose your first credit card, particularly in 2025 when there are so many options available. Building credit, earning incentives, and forming sound financial practices are all made possible with the correct credit card. But making the wrong decision could result in fees and high-interest debt.

The top 5 credit cards for beginners in 2025 are listed in this guide, with an emphasis on low fees, simple approval, and credit-building benefits for American consumers.

Best Credit Cards for Beginners in 2025

1. Discover it® Secured Credit Card AND Best Credit Cards for Beginners in 2025

Ideal For: Establishing credit without paying an annual cost

No annual fee

APR: fluctuating at 28.24%

Required Credit: Credit history is not necessary.

Why It’s Excellent: This secured card is a great choice for new users who seek rewards because it doubles your cash back in the first year.

Additional Benefits: 2% cash back at eateries and petrol stations.

Pro Tip: To prevent interest fees, pay in whole each month.

2. Capital One QuicksilverOne Rewards Credit Card

Ideal For: Constant cash back on all purchases

Annual Charge: $39

APR: fluctuating at 30.49%

Fair credit is required (580–669).

Why It’s Excellent: It is ideal for people who prefer simplicity because it offers a flat 1.5% cash back on all transactions.

Additional Benefits: Use Capital One’s CreditWise feature to keep an eye on your credit score.

Pro Tip: To rapidly establish a good credit history, use it for regular purchases and make your payments on time.

3. Chase Freedom® Student Credit Card

Ideal For: Students in college who are just beginning their credit journey

No annual fee

APR: fluctuating at 21.24%

Limited credit history is required.

Why It’s Excellent: offers a $50 incentive after your first purchase in addition to 1% cash back on other purchases.

Extra Benefits: After five on-time payments, your credit limit is raised.

Pro Tip: Ideal for young individuals hoping to establish a lasting connection with Chase’s credit network.

4. Petal® 2 “Cash Back, No Fees” Visa® Credit Card

Best For: Modern approval process and no fees

No annual fee

Variable APR: 18.24% to 32.24%

Required Credit: Credit history is not necessary.

Why It’s Excellent: Perfect for novices, it approves based on your banking history rather than your credit score.

Extra Benefits: 1% cash back up front, which rises to 1.5% after 12 timely payments.

Pro Tip: This is the safest choice if you’re concerned about unstated costs.

5. Citi® Secured Mastercard®

Ideal For: Easy credit development supported by a large bank

No annual fee

APR: fluctuating at 27.74%

Required Credit: Credit history is not necessary.

Why It’s Great: It allows you to establish credit without giving in to the urge to spend money on rewards.

Additional Benefits: Notifies each of the three main credit bureaus.

Pro Tip: For the best credit score outcomes, just use 10–30% of your credit limit.

How to Choose the Right Beginner Credit Card

Think about the following when choosing your first card:

1.Annual Fees: To cut expenses, start with zero or minimal fees.

2.APR: If you pay in whole each month, a high APR won’t be an issue.

3.Rewards vs. Credit Building: Choose between establishing credit and receiving cash back.

4.Certain cards require no credit history to be approved, while others require fair credit.

Beginner Credit Card Tips for 2025

Always Make On-Time Payments: Your FICO score is based in part on your payment history.

Maintain Low Utilization: Try to use no more than thirty percent of your credit limit.

Avoid Applying for Too Many Cards: Your score may suffer if you submit too many hard queries.

Examine statements every month to identify mistakes and prevent fraud.

Conclusion

In 2025, the best credit cards for newcomers are those that fit your spending patterns, likelihood of acceptance, and financial objectives. The secret is to utilize your card sensibly to position yourself for long-term financial success, regardless of whether you choose with the fee-free Petal® 2 or the rewards-rich Discover it® Secured.

4 Comments