Best Budgeting Apps for Couples in 2025

Introduction OF Best Budgeting Apps for Couples in 2025

Money is one of the most prevalent reasons couples dispute. Relationships can be strained by financial stress, whether it be from saving for a down payment on a home, organizing vacations, or determining how much to spend on groceries. In order to make money management simpler, more transparent, and even enjoyable, couples are using budgeting applications in 2025. These apps foster trust and teamwork in addition to aiding with expense tracking.

The top budgeting apps for couples in 2025 will be discussed in this post, together with their features, benefits, and drawbacks, as well as advice on how to pick the ideal one for your partnership.

Why Couples Need Budgeting Apps

Managing finances alone is not the same as managing money as a pair. Couples should use budgeting apps for the following reasons:

- Transparency: Assists both parties in understanding how funds are spent.

- Prevents Arguments: By keeping track of spending and dividing bills, disputes are avoided.

- Goal tracking: Couples can work together to develop and accomplish goals, such as organizing a wedding or purchasing a home.

- Time-saving: Applications streamline the tracking, reminders, and expense classification processes.

- Teamwork: Encourages collaborative decision-making rather than one partner bearing sole accountability.

Top 5 Best Budgeting Apps for Couples in 2025

1. Honeydue – Best Overall for Couples

One of the most often used budgeting apps for couples is Honeydue. It is intended to assist couples in handling joint spending while maintaining anonymity.

Important attributes:

View both individual and joint accounts in one location.

Establish monthly spending caps for things like rent, groceries, and meals.

Use the in-app chat function to have brief conversations about costs.

Bill reminders that happen automatically.

The reason why couples adore it is that it permits openness without requiring them to divulge every single detail. Couples at any stage of their relationship will find it comfortable because you have the ability to control what your spouse sees.

2. Goodbudget – Best for Envelope Budgeting

The traditional “envelope budgeting” method is brought into the modern day via Goodbudget. Couples can allocate funds for things like food, rent, or leisure into virtual envelopes.

Important attributes:

- allows both parties to view updates instantaneously by syncing across devices.

- envelopes that can be customized for various spending categories.

- Excellent for couples who wish to strictly limit their spending.

Why Couples Love It: It fosters discipline and helps couples avoid overspending, particularly when saving for major objectives.

3. Zeta Money Manager – Best for Transparency

Zeta is designed with families and couples in mind. In the US, it provides a shared bank account option in addition to tracking spending.

Important attributes:

- Automatically divide expenses.

- Use a single app to manage both personal and shared funds.

- Bill reminders and savings targets.

- qualities that are suitable for families with children.

Why Couples Love It: Zeta strikes a balance between shared duty and individual freedom, making it ideal for real-life couples.

4. YNAB (You Need A Budget) – Best for Goal Setting

For individuals and couples who wish to take charge of their long-term financial situation, YNAB is a robust budgeting app.

Important attributes:

- aids in setting monthly and annual objectives.

- monitors the status of debt repayment.

- uses educational tools to teach money management.

- Features for reporting and bank syncing.

Why Couples Love It: For couples who are serious about saving for life events like retirement or home ownership, YNAB is worth the monthly charge.

5. Mint – Best for Beginners

One of the easiest-to-use and most cost-free budgeting tools is Mint. For couples who are just beginning their financial journey together, it’s ideal.

Important attributes:

- automatically monitors spending from bank accounts.

- free tracking of credit scores.

- spending warnings for anomalous behavior.

- Basic user interface for novices.

Why Couples Adore It: Mint is a comprehensive budgeting tool that spares users from being overloaded with options.

Best Budgeting Apps for Couples in 2025

How to Choose the Right Budgeting App as a Couple AND Best Budgeting Apps for Couples in 2025

How do you choose the best app for you and your spouse when there are so many to choose from? Here are some things to think about:

- Financial Objectives: Are you planning a wedding, saving for a home, or simply dividing your rent? Select an app based on your needs.

- Usability: While some apps, like Mint, are simple for novices, others, like YNAB, demand more work but provide more in-depth information.

- Privacy: Seek out applications that provide you the ability to limit your partner’s access.

- Cost: While free applications are a terrific place to start, there are instances when paid programs, like YNAB, are worth the money.

- Device Compatibility: Verify that you and your spouse can use the app without any issues on both iOS and Android.

Tips for Couples to Manage Money Better AND Best Budgeting Apps for Couples in 2025

Financial difficulties cannot be resolved by apps alone. The following routines increase the effectiveness of budgeting as a couple:

- Establish Money Dates: Arrange a meeting once a week or once a month to talk about objectives and spending.

- Establish shared objectives: Putting money aside for a wedding, a trip, or an emergency fund improves teamwork.

- Automate Savings: To save money automatically, use applications or bank transfers.

- Be Truthful: Being open and honest about debts, earnings, and spending patterns helps to prevent unpleasant shocks.

- Celebrate Your Progress: Give yourself a treat when you reach significant financial goals.

FAQs on Budgeting Apps for Couples

- Are apps for budgeting safe to use?

Yes, the majority of apps employ encryption and security at the bank level. Select apps with robust privacy policies at all times. - Does the same app have to be used by both partners?

Yes, both need install the same app and sync their accounts in order to collaborate effectively. - Should we purchase premium apps or are free ones sufficient?

Most couples find success with free apps like Mint and Honeydue. Purchasing a premium software like YNAB can be worthwhile if you have long-term financial objectives. - Can financial advisors be replaced by budgeting apps?

No, but they can simplify day-to-day financial management and lessen the need for regular expert assistance.

Conclusion OF Best Budgeting Apps for Couples in 2025

Relationship problems don’t have to arise from money management. The top 2025 budgeting apps for couples, including as Honeydue, Goodbudget, Zeta, YNAB, and Mint, provide strong tools for tracking spending, saving money, and achieving financial objectives as a couple.

Selecting the appropriate app will help you and your spouse develop trust, prevent financial stress, and reach financial independence together, regardless of whether you’re just beginning your financial journey or making long-term investment plans.

Couples who budget together develop together, so get started now.

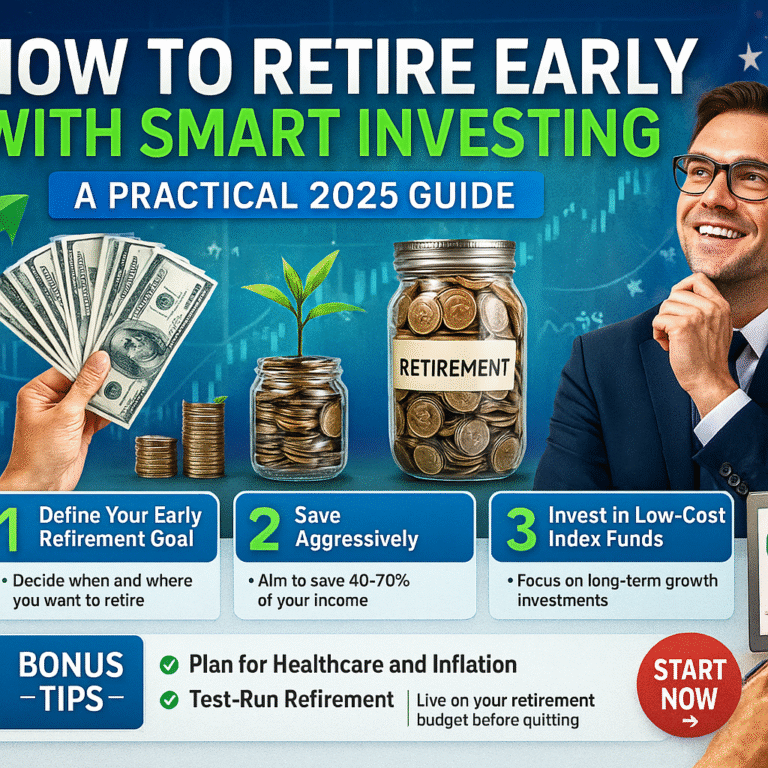

how-to-start-investing-in-index-funds-2025