Best Automated Investment Apps 2025: A Smarter Way to Grow Your Money

Best Automated Investment Apps 2025

INTRODUCTION OF Best Automated Investment Apps 2025

Investing doesn’t have to be difficult these days. Technology has made it easier for both novice and seasoned investors to increase their wealth without having to deal with the hassles of manual trading. These apps are more intelligent, quicker, and more reasonably priced in 2025 than they were in the past.

The top automated investment apps of 2025 will be discussed in this article, together with its salient characteristics, advantages, and disadvantages, as well as how to pick the ideal one for your financial objectives.

Why Use Automated Investment Apps?

Artificial intelligence and algorithms are used by automated investment apps, often known as robo-advisors or smart investing platforms, to:

- Create and oversee diversified investment portfolios

- Automatically rebalance when markets change

- Less expensive than typical financial counselors

- Encourage novices to begin investing with modest sums.

- Save time and earn money at the same time.

Users can benefit from professional-style portfolio management with little effort.

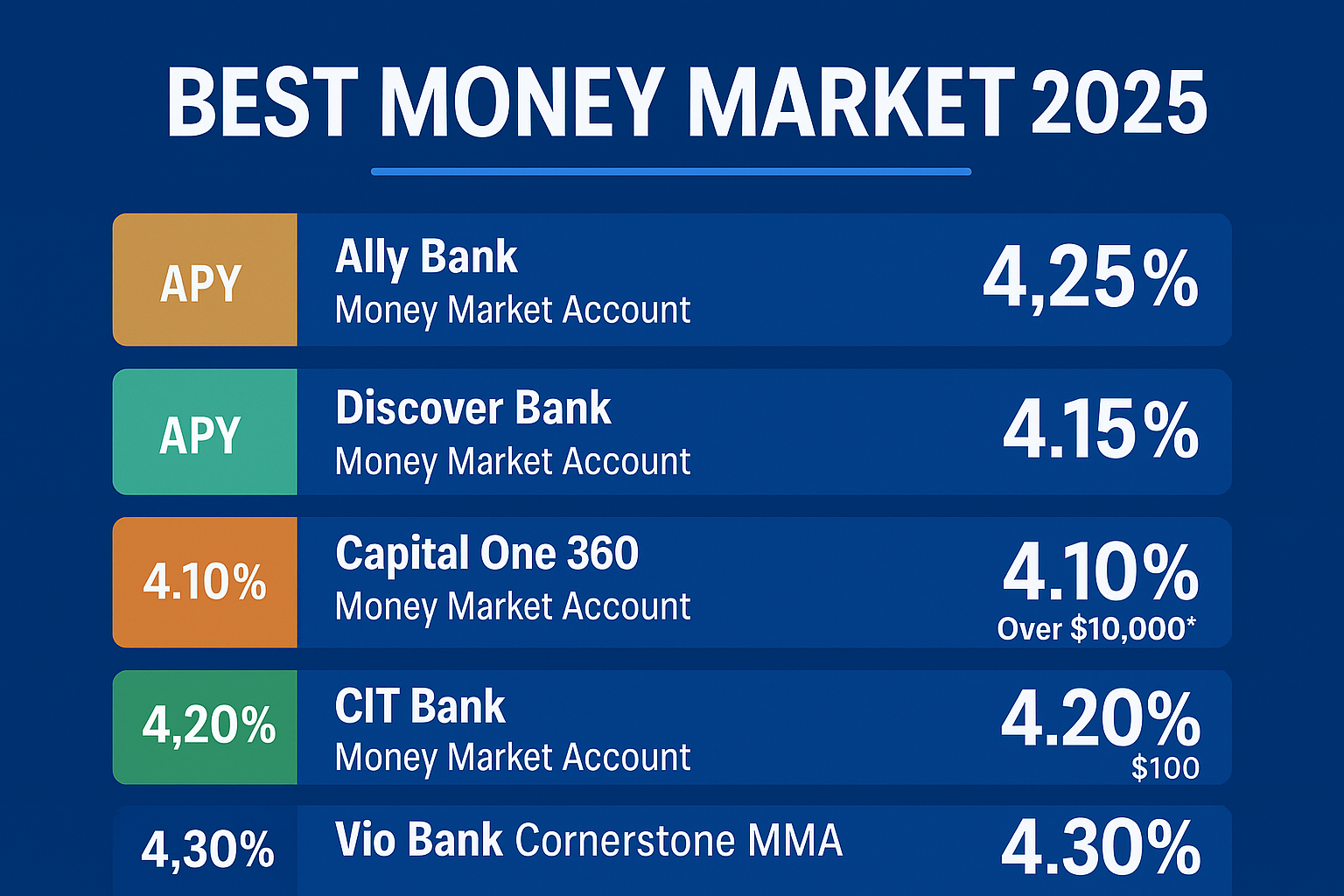

Best Automated Investment Apps in 2025

1. Betterment

Ideal for Novices

One of the most well-liked automated investment programs is still Betterment. It provides retirement planning, tax-loss harvesting, and customized portfolios.

Advantages: ✔ Minimal costs (0.25% yearly) ✏ User-friendly mobile application ✔ Automatic tax planning

Cons: ✘ Less personalization than do-it-yourself investment

2. Wealthfront

Ideal for Setting Goals

Wealthfront offers robust financial planning tools, such as calculators for college savings, house ownership, and retirement.

Benefits: ✔ Numerous ETF investing options ✔ Advanced goal-based tools ✔ No requirement for a human advisor

Cons: ✘ No real financial advisors available for one-on-one counseling

3. Acorns

Ideal for Small-Scale Investments

Acorns is an excellent choice for novices who wish to begin modestly. It invests spare change that is automatically rounded up from regular transactions.

Advantages:

- ✔Simple to begin with a small initial investment

✔ Features additional cashback incentives - ✔ Beginner-friendly educational content

Cons:

✘ For very little balances, the monthly charge may be considerable.

4. Fidelity Go

Ideal for Inexpensive Investing

A reliable financial institution supports Fidelity Go, the company’s robo-advisor. For balances under $25,000, it is free.

Advantages: ✔ Fidelity’s financial expertise supports smaller accounts with no management fees ✔ Excellent customer service

Cons: ✘ Limited possibilities for customisation

5. M1 Finance

Ideal for Personalized Portfolios

M1 Finance blends do-it-yourself investment with robo-advising. Custom “pies” of stocks and ETFs can be made by users.

Advantages: ✔ Investing in fractional shares ✔ No management costs ✔ Adaptable and customisable

Cons: ✘ Not the best option for total novices

How to Choose the Right Automated Investment App

When choosing an app for investing, take into account:

costs: Long-term returns are diminished by even minor costs.

Minimum Deposit: You can begin using certain apps with as little as $5.

Features: Do you require customisation, tax-loss harvesting, or goal planning?

Easy to Use: Beginners can maintain consistency with a straightforward, uncluttered program.

Support: While some programs are entirely automated, others offer human counselors.

Final Thoughts OF Best Automated Investment Apps 2025

By 2025, automated investment applications will have completely changed how people accumulate wealth. These applications make investing easier than ever, whether your goal is to save for a house, retirement, or just to put your money to work.

Acorns or Betterment might be the best options for you if you’re new. 👉 M1 Finance is the best option if you want greater control. 👉 Wealthfront is the best option for sophisticated planning.

Consistency is essential, regardless of your decision; start small, maintain discipline, and let automation do the heavy lifting.

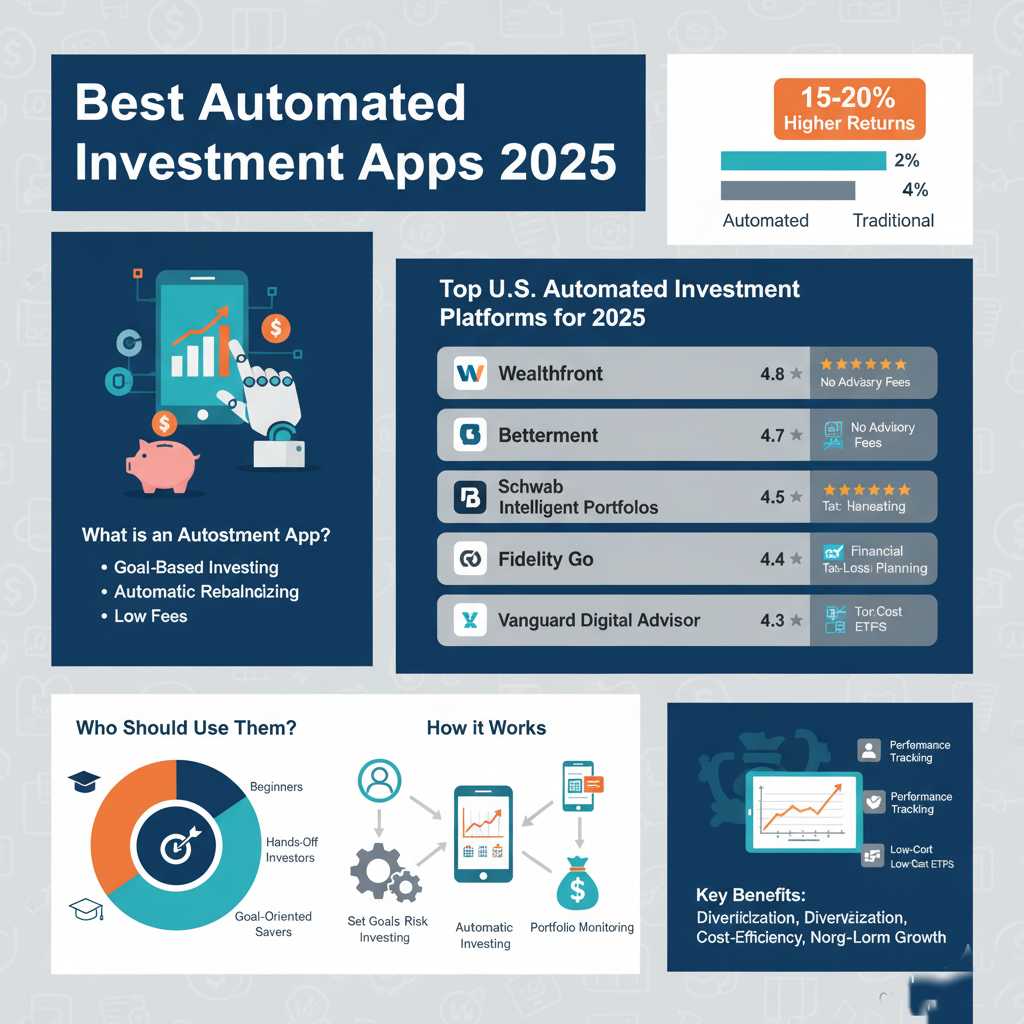

best-money-market-accounts-2025