Beginner Investment Strategies 2025: Smart Ways to Start Without Losing Money

Beginner Investment Strategies 2025

Introduction Of Beginner Investment Strategies 2025

Compared to investing five years ago, investing in 2025 looks significantly different. It is now easier than ever for novices to begin investing, but it is also more difficult to determine which course to follow due to new technologies, shifting interest rates, and changing international markets.

Beginners need realistic ways to invest wisely, steer clear of frequent pitfalls, and accumulate long-term wealth rather than jumping into the stock market blindly.

We’ll discuss innovative starter investment techniques for 2025 in this blog, which go beyond the conventional “put money in a savings account” recommendation.

1.Start with a “Financial Foundation” Fund

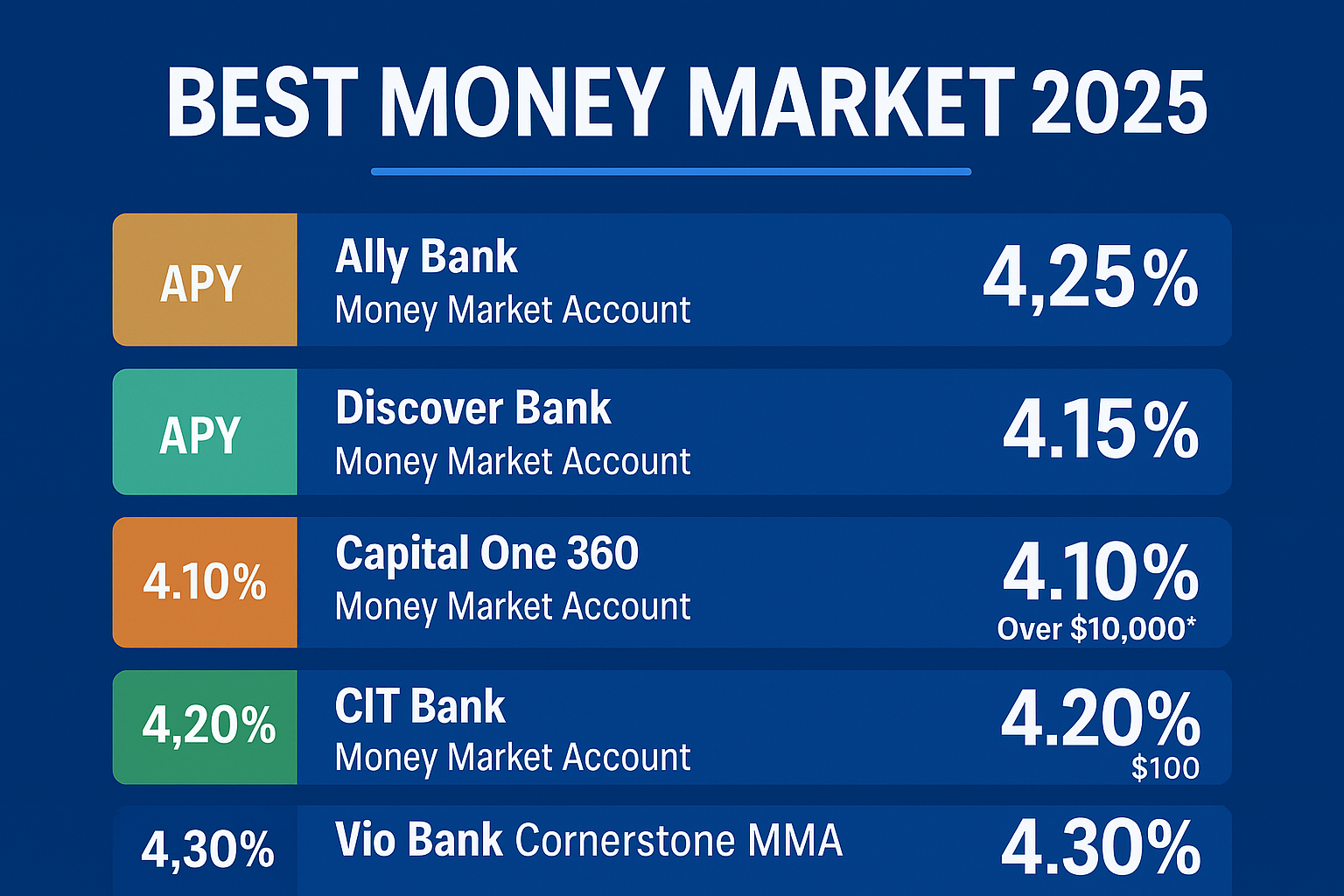

Beginners should create a financial foundation fund, which consists of a combination of cash savings and short-term, secure investments, before making stock or bond investments.

- In a liquid account, aim for three to six months’ worth of living expenditures.

- In 2025, invest a portion of it in money apps or short-term digital bonds that offer 4–5% annual percentage yield.

- This guarantees that you won’t have to liquidate your investments in times of need.

This is a strategy rather than a product; it involves building a foundation before looking into options with higher returns.

2.Use the “50/30/20 + Invest” Rule

The 50/30/20 ratio is recommended by conventional budgeting counsel (50% necessities, 30% wants, 20% savings). Beginners should update this to: in 2025

- 50% Requirements

- 30% Desires

- 10% Off

- Ten percent of investments

Over time, even a modest monthly investment might add up to a substantial sum. By setting aside 10% for investing, novices form a solid financial habit.

3.Micro-Investing Apps for Habit Building

In 2025, new finance platforms will enable microinvesting, with a $5 starting point. Apps that collect spare change and automatically invest it include Acorns, Stash, and Public.

This tactic aids novices:

- Establish consistency

- Lessen your anxiety about big investments

- Instead of waiting, learn by doing.

4.Invest in ETFs That Match Personal Values

In 2025, novices can investigate value-based ETFs as an alternative to generic index funds:

- ETFs for green energy

- ETFs for tech innovation

- ETFs for healthcare

This approach makes investing interesting and personal, which is important for novices who would otherwise get disinterested or overwhelmed.

5. Use “Dollar-Cost Averaging” (DCA)

Beginning investors should use DCA, which involves investing a set amount on a weekly or monthly basis, rather than worrying about market timing.

- lowers the chance of making a purchase at “the wrong time.”

- develops self-control.

- produces steady, long-term growth.

6.Try Fractional Shares

In 2025, beginners don’t need thousands of dollars to buy big stocks like Tesla, Amazon, or Apple. Fractional shares allow buying small portions of high-priced companies.

This strategy makes stock investing affordable while maintaining diversification.

7.Balance “Safe + Growth” with a 70/30 Mix

Beginners frequently make the error of taking on too much risk or being too cautious. A smart beginning mix in 2025 would resemble this:

- 70% safe (bonds, ETFs, or savings)

- 30% growth in innovation funds, tech stocks, or cryptocurrency exchange-traded funds

This approach exposes investors to high-return regions while maintaining stability.

8.Automate Your Investing

One of the most popular beginner-friendly tactics for 2025 is automation. Establishing automatic transfers to brokerage accounts or robo-advisors eliminates choice fatigue and maintains steady investment growth.

- minimizes emotional errors

- ensures sustained dedication

- releases mental energy.

9.Learn Risk by “Simulation First”

Beginners should use trading simulators rather than instantly investing all of their money in genuine markets. You can test ideas with fictitious money using apps like TradingView and the simulator on Investopedia.

This benefits new investors:

- Recognize volatility

- Build confidence

- Steer clear of expensive blunders in real life.

10.Stay Updated with AI-Driven Investment Tools

Strong AI-based investing assistants with tailored suggestions will be available by 2025. These resources can be used by novices to:

- Monitor spending trends

- Make safe allocation suggestions.

- Be mindful of the dangers

This tactic guarantees that novices traversing intricate marketplaces won’t feel lost.

Common Mistakes Beginners Make in 2025 AND Beginner Investment Strategies 2025

- Overreacting to News: Markets are influenced by headlines, but novices should not panic.

- Chasing “Hot” Investments: Do your homework before investing in trends.

- Ignoring Fees: Over decades, low-cost investments compound more effectively.

- Lack of Goals: When investing, bad choices are made when there is no clear goal in mind.

Conclusion Of Beginner Investment Strategies 2025

It doesn’t have to be difficult to invest in 2025. Focusing on tactics that foster habit formation, safeguard finances, and permit consistent progress is crucial for novices.

Anyone may begin safely accumulating wealth, even with modest sums, by combining a solid foundation fund, regular investment practices, automation, and user-friendly technologies.

Achieving financial freedom takes time and effort. The key is to start wisely, maintain consistency, and let time handle the heavy lifting.