“Building a Robust Investment Portfolio in 2025: A U.S. Investor’s Guide”

Robust investment portfolio

Introduction Of Robust investment portfolio

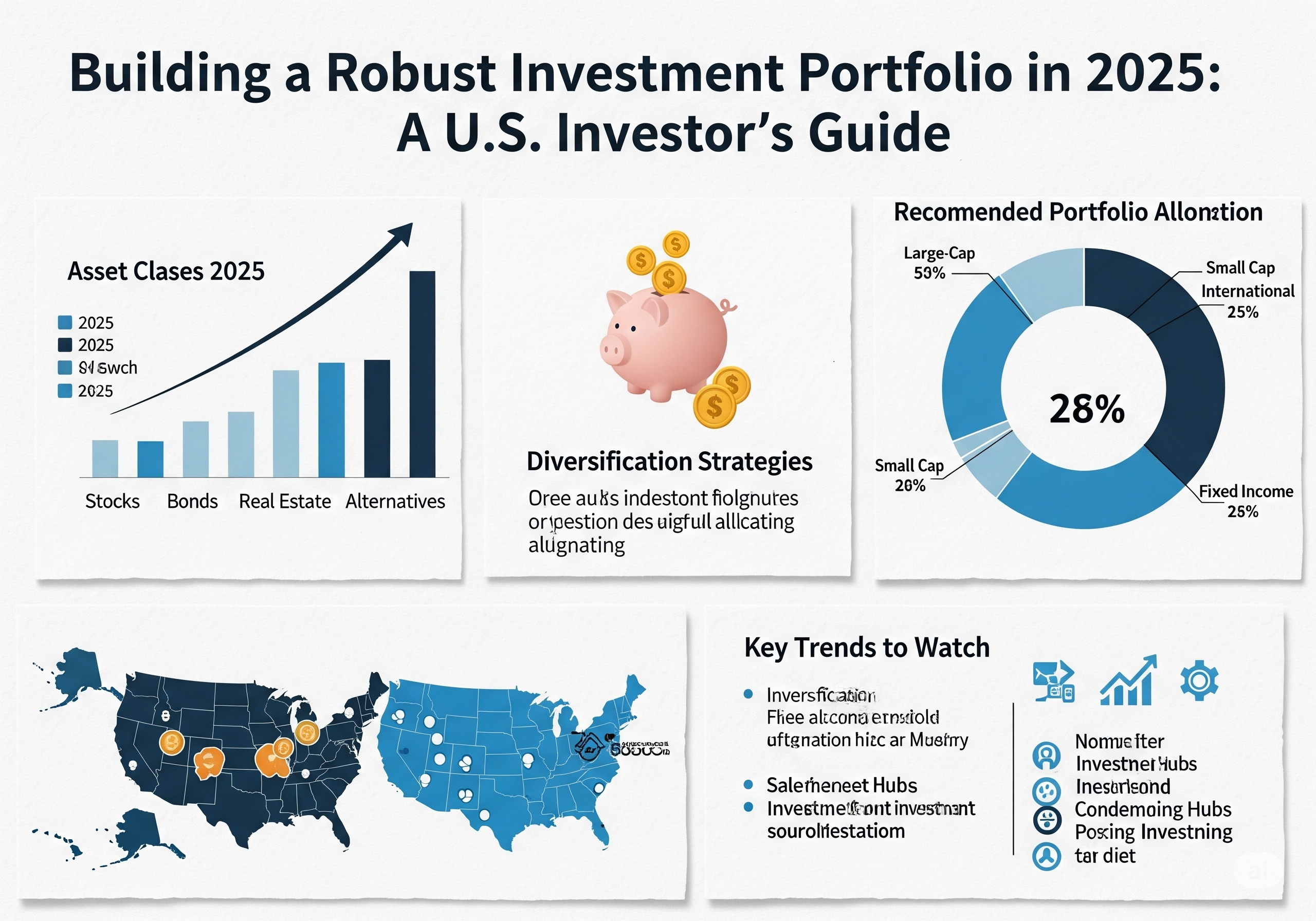

In 2025, the financial environment in the United States will be more complicated. Investors encounter difficulties that need for careful planning and disciplined investment due to inflation, shifting interest rates, and worldwide economic concerns. In addition to growth, a strong investment portfolio is necessary for capital protection, steady income generation, and reaching long-term financial objectives.

A robust portfolio balances risk and reward, adjusts to market fluctuations, and makes sure investors can weather both downturns and expansions, in contrast to one that is exclusively focused on high returns. This entails combining stocks, bonds, real estate, and other assets for American investors in order to create stability, income, and possible growth prospects.

Understanding a Robust Investment Portfolio

Long-term growth, flexibility, and stability are the goals of a strong portfolio. Important traits consist of:

- Investing across a variety of asset types lowers exposure to any one economic event.

- Risk management: By aligning investments with your level of risk tolerance, you can save cash while still pursuing expansion.

- Adaptability: Regular portfolio evaluations and rebalancing guarantee conformity with changing market circumstances and individual financial objectives.

A hypothetical allocation of $100,000 by a U.S. investor may look like this: 50% in stocks, 30% in bonds, 10% in real estate or REITs, and 10% in alternative assets like commodities or developing technology-focused ETFs.

Core Components of a Robust Portfolio

Allocation of Diversified Assets

Risk is reduced by diversifying across sectors, industries, and asset classes. This could involve the following for US investors:

- Growth stocks in renewable energy, healthcare, and technology

- Stocks that pay dividends for steady income

- Government and corporate bonds for stability

- Real estate investments for diversification, or REITs

Investments That Generate Income

A consistent cash flow is provided by dividends and bond interest, which is particularly crucial during times of market turbulence.

Other Resources

Adding commodities, precious metals, or exchange-traded funds (ETFs) that monitor developing industries lessens dependency on established markets and acts as a volatility hedge.

Stability and Quality

Putting money into businesses with solid financials, steady profits, and a competitive edge guarantees that your portfolio can weather market volatility.

Strategies to Build a Robust Portfolio

- Frequent Rebalancing of the Portfolio

After market fluctuations, rebalancing allocations on a quarterly or annual basis keeps risk in line with your goals. - Cost in dollars Average

By investing a certain sum at regular times, average purchasing costs are smoothed over time and the effects of market volatility are lessened. - Treasury for Inflation Protection During inflationary times, commodities, real estate, and inflation-protected securities (TIPS) all contribute to the preservation of buying power.

- Tax-Efficient Investing: After-tax gains can be maximized by using Roth IRAs, 401(k)s, or HSAs. To optimize growth, taxable and tax-advantaged accounts should be balanced.

- Investing in Sustainability

Strong ESG standards-abiding businesses typically have lower regulatory risk and longer-term resilience, which makes them desirable additions to a portfolio with a U.S. concentration.

Tools and Resources for U.S. Investors

Tools for Portfolio Management:

- Morningstar for detailed research

- Tracking and retirement planning with personal capital

- Fidelity and Vanguard for managing ETFs and mutual funds

Expert Advice:

For your financial objectives in the United States, Certified Financial Planners (CFPs) can provide risk assessment, portfolio monitoring, and customized strategies.

Resources for Education:

- Investopedia offers user-friendly guides for beginners.

- For stock analysis and research, use The Motley Fool.

- For helpful guidance on credit, retirement planning, and investing, visit NerdWallet.

Key Takeaways

Reduce exposure to specific market risks by diversifying across asset classes.

Strike a balance between income and growth by combining steady income-producing investments with high-growth assets.

Incorporate TIPS, real estate, or commodities to guard against inflation.

Rebalance Frequently: Stay in line with your risk tolerance and financial objectives.

Make Use of Expert Resources and Advice: To make wise choices, consult consultants, educational platforms, and apps.

Conclusion Of Robust investment portfolio

Creating a strong investment portfolio in 2025 is a methodical process that calls for careful diversification, strategic planning, and ongoing oversight. Achieving long-term financial objectives for American investors requires striking a balance between growth, stability, and income. A diversified, flexible, and inflation- and market-risk-protected portfolio can weather economic turbulence and set you up for long-term wealth building.

U.S. investors may successfully traverse the complex financial landscape of 2025 by adhering to these principles and putting practical tactics into practice. This will ensure that their investments are robust, resilient, and capable of accomplishing both short-term and long-term goals.

tax-efficient-investing-u-s-2025

One Comment