How to Successfully Start Investing in Index Funds in 2025: A Simple Guide for Beginners

How to Start Investing in Index Funds 2025

Intoduction Of How to Start Investing in Index Funds 2025

Index funds are among the greatest options if you’ve been looking for an easy, affordable strategy to increase your wealth in 2025. They have a solid track record of producing long-term returns, are diversified, and are accessible to beginners.

Even if you have never invested before, this book will teach you exactly how to start investing in index funds in 2025, as well as what they are, their benefits and drawbacks, and how to get started.

Index funds are a strong option if you’re searching for one of the simplest ways to increase your wealth in 2025 without devoting hours to stock market research. They are reasonably priced, easy for beginners to use, and have a track record of producing substantial long-term profits. Index funds simply follow the market rather than attempting to outperform it, which ultimately benefits the majority of investors. This book will explain how to begin investing in index funds in 2025, their advantages, and the doable actions you can take right now to begin accumulating long-term wealth.

What Are Index Funds? How to Start Investing in Index Funds 2025

An investment that tracks a particular market index, such the S&P 500 or the Nasdaq 100, is called an index fund. Index funds mimic the performance of the market they track rather than attempting to outperform it.

This “passive investing” strategy removes the necessity for ongoing stock selection while keeping expenses low.

Why Invest in Index Funds in 2025?

- Cheap Prices

With expense ratios as low as 0.03%, index funds allow you to keep more of your money invested. - The process of diversification

You can invest in hundreds or even thousands of stocks with a single purchase. - Reliable Performance

In the long run, index funds have historically performed better than the majority of actively managed funds. - Easy for Novices

Set it and let it develop; they don’t need sophisticated plans or market timing.

Types of Index Funds to Consider

Track the 500 biggest American corporations with S&P 500 Index Funds.

The entire U.S. stock market is covered by total stock market index funds.

Diversify into markets outside of the United States with international index funds.

Bond index funds offer income and stability.

Step-by-Step: How to Start Investing in Index Funds in 2025

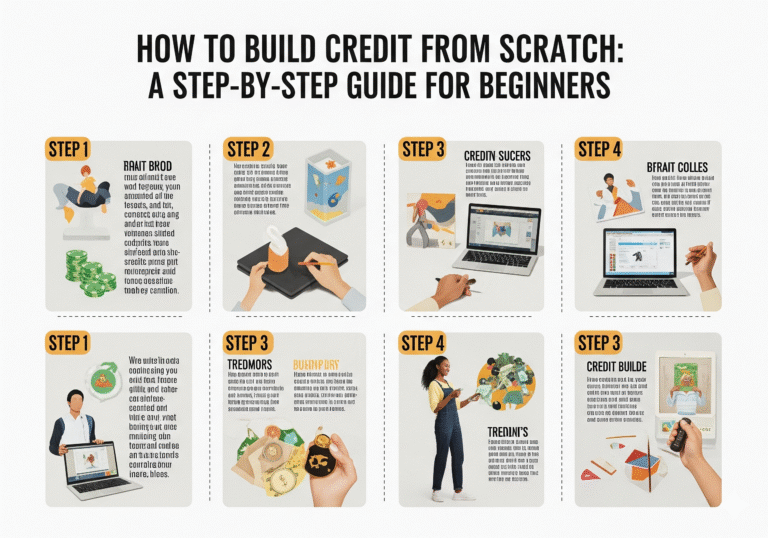

Step 1.First, create a brokerage account.

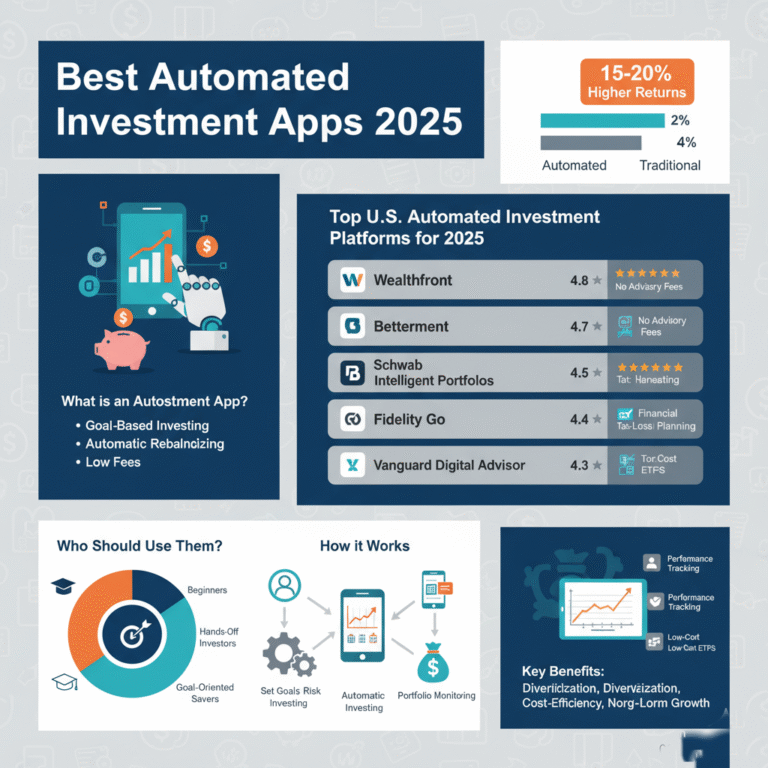

Select an app like Robinhood or M1 Finance, or a respectable U.S. firm like Vanguard, Fidelity, or Charles Schwab.

Step 2.Selecting Your Index Fund in Step Two

Seek out:

- low ratio of expenses

- lengthy history

- Elevated liquidity

For instance, the Fidelity ZERO Total Market Index Fund (FZROX) and the Vanguard 500 Index Fund (VFIAX).

Step 3: Choose the Amount to Invest

Some platforms allow you to start with as little as $50 to $100. For steady growth, set a monthly contribution.

Step 4: Configure Investments Automatically

Automating takes the emotion out of decision-making and gradually increases wealth.

Step 5: Long-Term Hold

Avoid the temptation to sell in a panic when the market is down. Over ten years or more, index funds perform best.

Risks to Be Aware Of

- Market Volatility: The value of your fund may temporarily decline.

- No Promised Returns: Although historically robust, past performance does not ensure future outcomes.

- Currency Risk: This applies to foreign index funds.

Tax Tips for Index Fund Investors

For growth that is tax-free, use a Roth IRA.

To reduce capital gains taxes, select funds with low turnover for taxable accounts.

Example Beginner Portfolio

- Seventy percent of the US Total Stock Market Index Fund

- 20% Global Index Fund

- 10% Index Fund for U.S. Bonds

- This combination offers stability as well as progress.

Final Thoughts Of How to Start Investing in Index Funds 2025 – Beginner’s Guide

Understanding simplicity, consistency, and patience are key to knowing how to begin investing in index funds in 2025. They provide a simple, stress-free route to long-term prosperity for the majority of novices.

Compounding can help you reach your financial objectives if you start investing today, automate it, and stick with it through market fluctuations.

how-to-build-a-high-yield-emergency-fund-in-2025

how-to-build-a-6-month-emergency-fund

6 Comments